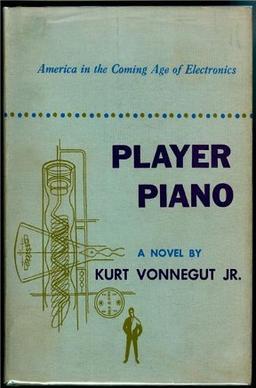

Player Piano is the first novel by American writer Kurt Vonnegut Jr., published in 1952. The novel depicts a dystopia of automation partly inspired by the author’s time working at General Electric, describing the negative impact technology can have on quality of life.

I spent a lot of time yesterday cleaning up errors and misjudgments in the Bulgaria pages. I had published one page as a post which I didn’t notice until a couple days ago. Then there were the pictures. I have finally settled on what format they are going to take so went back and redid the fist 2-3 pages to make them all the same style.

The picture galley that is native to WordPress is functional but that is about all you can say for it. Like almost everything in WordPress, if you want something that works and looks good you need to install a plugin. I’m using the free version of FooGallery. There is a Pro version that starts at $100 for a lifetime buy or $6 per month; there are other Pro versions that go up in price from there. Also using the free FooBox; that is a pop up showing the pictures that are in the FooGalley in a bigger slide format. The Pro version of that one is also $100 lifetime or $5 per month.

I also did the month end house cleaning and moving preparation yesterday. I’m ready to leave here Thursday morning with a stop along the way to stock up on groceries that I hope will be enough to last me a month. The new camp is rather remote for shopping so this is going to be an experiment to open up other camps to me.

The best we can hope for is a process that facilitates the gradual decrease in dollar demand over a lengthy period of time, allowing the U.S. and other countries to adjust accordingly. A multipolar monetary system might provide a more equitable playing field to poorer countries and just maybe give the U.S. and the world longer-term economic and political stability. The likely outcome of this would still be quite chaotic and involve a drop in the standard of living for Americans. Nevertheless, this path appears inevitable, and such an option is preferable to the inevitable turmoil of the more extreme scenarios we have seen throughout history. — De-dollarization: Not a matter of if, but when by Frank Giustra

…[I]t (the US dollar) has the full faith and credit of the U.S. government behind it, a status which gives it credibility and reliability that other central banks and asset managers around the world count on. But that credibility is now under threat due to a confluence of forces. First, U.S. debt is now $31 trillion and rising. After averting a disastrous default in 2011, Republicans in Congress are flirting with the idea of not raising the debt ceiling. This would risk defaulting on the government’s financial obligations and thereby invalidating Washington’s “full faith and credit.” — Is China poised to help other unaligned powers usurp the dollar? by Amir Handjani